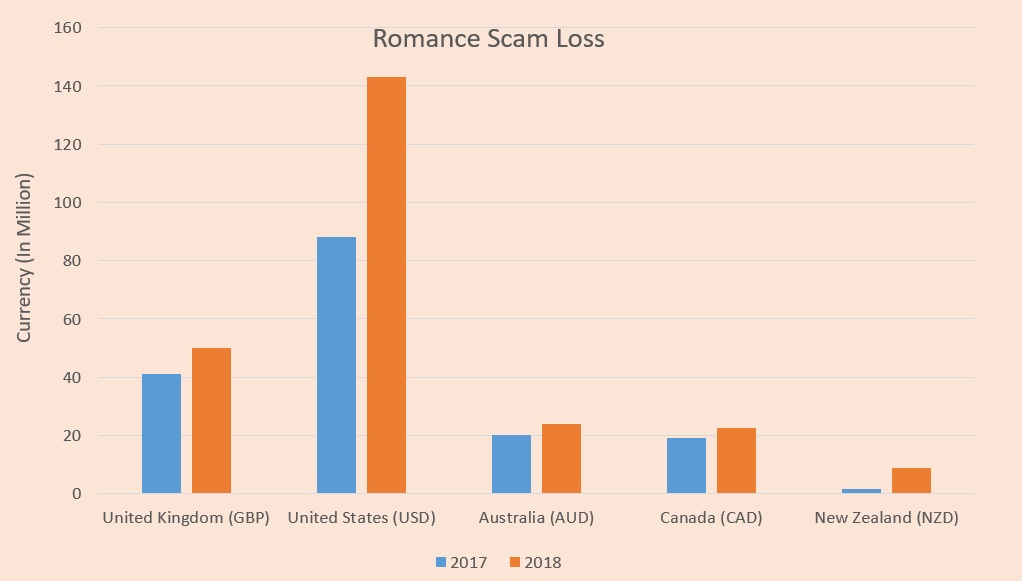

The movie ‘You’ve got a mail‘ is one of the tellows’ team favorite movies. But my readers, how many of us can become Joe and Kathleen in real life? Unfortunately, more people are falling victims to ‘romance scams’ regardless of gender, according to the official information* of many countries. Let us have a look at the figure:

*Information from ACCC, FTC, Action Fraud, RCMP and Netsafe.

The numbers above are surprisingly alarming. In the US, the losses of romance scams rose from $33M to $143M in 2015 to 2018 as stated in FTC. Online dating becomes more popular and common nowadays, thanks to the technology we can meet endless potential romantic partners online. However, we also become more vulnerable when there are scammers try to take advantages of the online dating platforms.

Continue reading