Dear readers,

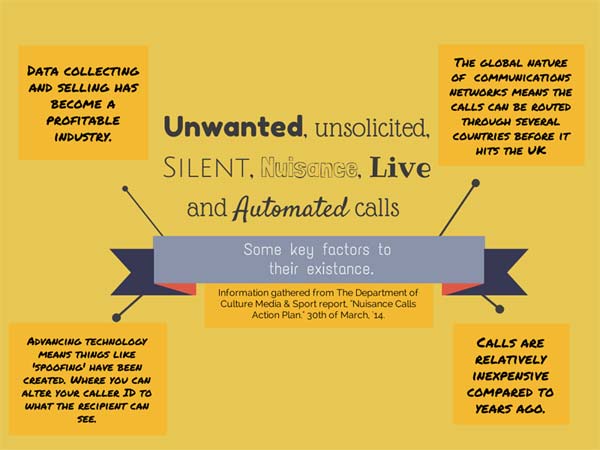

Here we are in the season of Springtime tax scams, again scammers are trying to take advantages from us, especially targeting the young people and the senior as stated by HMRC. The numbers of youngsters and the elder possessing a smartphone is growing through these years. According to Ofcom Communications Market Report 2018, over half of the population who aged over 55, and 95% of young people (from 16 to 24) own a smartphone in the same period. This means that fraudsters have higher chances to scam people successfully through bogus text messages or phone calls.

Phone scammers are directing at youngsters and the vulnerables since most of them are less familiar with the tax system. HMRC stated that close to 2,500 reports of tax scams were reported per day last Spring, with roughly 250,000 reports received in total during the whole season.

Scammers are most likely approaching potential victims with refund scams in the tax period by email or texts pretending to be HMRC. They will offer a tax refund or payment for around 100 pounds in exchange for personal information such as bank account details. Be prepared for phishing websites. HMRC already made 6000 requests to shut down these cloned websites last tax season. Moreover, Fraudsters mostly asked for immediate action, therefore beware of phrases like ‘you only have 2 days to reply’ or ‘urgent action required’ in text messages or e-mail.

According to Head of Action Fraud, Pauline Smith:

“These criminals will contact victims in many ways including spoofed calls, voicemails and text messages. People should spot the signs of fraud and be wary of emails with attachments which might contain viruses designed to obtain personal or financial information.”

Take Five, the national campaign that advises on protection against financial fraud, Katy Worobec:

“The offer of a tax rebate might sound tempting, but don’t let the criminals hoodwink you into giving away your details or your cash. If you’re worried that you might have given away any of your information, then contact your bank straight away.”

继续阅读