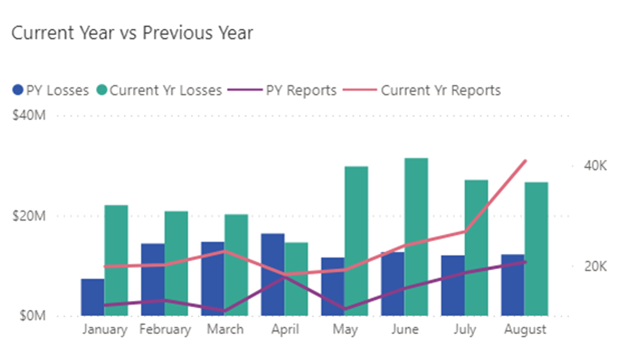

Scam Losses Rise

In 2021 Scamwatch reported, that losses exceeded $211 million in the phone scam area between January and September. This numbers is even higher than it was for the whole year 2020. In 2021 Scamwatch received over 113,000 reports about phone scams.

Less people reported losing money in 2021. On the other hand, those people who lost money, have lost larger amounts with an average loss of $11,000.

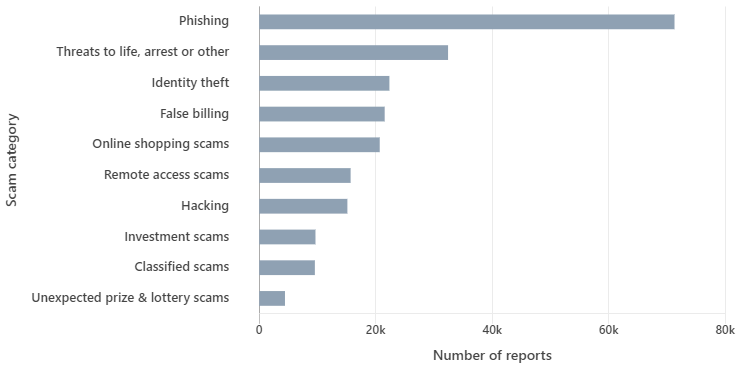

Common Types of Scams

Scammers like to tell stories and make you believe that the call is urgent by putting pressure on you. For example there is a time senstitive event with only limited offers left or your safety is at risk when you don’t allow access to your computer or pay a debt immediately. Sometimes they pretend to be from well-known company or your insurance. Maybe you also receive a text message or a silent call where you have no chance to even answer the phone. These are just some tricks Australian scammers use to make you call back and share sensitive data.

It’s very concerning to see these scams evolving and becoming more sophisticated to steal even more money from unsuspecting people. – ACCC Deputy Chair Delia Rickard

Phishing

A person contacts you pretending to be from a legitimate business such as a bank, your insurance company or your internet service provider. The scammer wants to confirm your personal details. For example, the caller may say that the service provider is verifying customer records due to expired contracts.

It can also happen that the scammer from a known company brand is calling you and telling you that there have been unauthorized payments or account activities. In order to verify the activities, you should give him your personal details like bank account information.

Text messages with phishing links getting more and more popular. The links take you to websites that look real and make you enter your data. But instead to the real service, it will be directed to the scammers.

Identity Theft

Scammers can get your details by phishing, hacking your computer, remote access, malware, document theft, data breaches or from you directly if you gave out your personal details over the phone to someone claiming to be for example from your bank or the Amazon customer service.

With your personal information, scammers can access your bank account, take loans, sign contracts, purchase goods, access your mail or other accounts. Identity theft should be reported to the police. Make sure to change your passwords often and tell other people your personal details with caution. The IDCARE is a service to help you with identity theft and provides cyber support.

Investment Scams

Investment scams try to trick you by promising large payouts and guaranteed returns. Investment opportunities from trustworthy banks don’t usually contact people via phone. Often the promises are with “low risks”. It should ring a bell as soon as you hear that – it is too good to be true.

Those scams can be hard to spot, especially for people with no experience in investments and trading. You should never agree to an investment over the phone without having details about the company. You can also look for financial advice beforehand.

Since Bitcoin and Co. are on a rise, the cryptocurrency scammers are just around the corner. It is very difficult to keep legitimate cryptocurrency investments apart from scams. Scammers take advantage of the hype and your lack of knowledge. You can check for company details and licenses of the investment company that called you in the ASIC register. Moneysmart also offers details about companies you should not deal with and that had negative references in the past.

Threats And Extorsion

Those threats are designed to frighten you into handing over your money. With lots of pressure you are threaten with an arrest or large payments unless fast action is taken.

Scammers tend to target vulnerable people, such as the elderly or new immigrants. They impersonate government officials like the police or tax officials and report that there are problems with papers unless a fee or debt is paid. Because everything is so sudden many people hand over money without seeking help because they fear for their safty.

The scam is designed to scare you into handing over your money without seeking any further assistance. Out of fear many people fall for this scam.

COVID-19 Scams

Lots of scammers use the Corona virus to make money. Common scams include phishing for personal information and online shopping.

Caller request payments e.g. for vaccines or offers to pay money as an investment opportunity in the Pfizer vaccine. Also fake surveys related to vaccines that offer prizes or early access have been reported.

Scammers are also sending text messages pretending to be from the government. They send messages regarding COVID-19 like that you have been in contact with someone who is infected. They add links to dubious pages to get to your personal details (phishing).

How To Detect A Scam

- Don’t answer calls if you don’t know who the caller is. You can always call back once you know the call is legitimate. If the caller leaves details on voicemail, check online if the company is trustworthy and if the caller’s infroamtion match.

- Don’t reply or click on any links in text messages.

- Don’t authorize payments or tell anyone your personal details like address or bank information.

- Don’t let someone take control of your computer.

- If someone is putting pressure on you, it is likely a scam. Genuine businesses don’t pressure their (future) customers.

- Ask for information about the company that is calling and the name of the caller. You can check this information online before talking to them again or agreeing to any contracts.

What You Can Do

- Check if an unknown caller was reported on tellows-au.com yet and leave a report yourself to warn others about the caller.

- Block callers with the help of an app like tellows or get more information from your phone company.

- On your landline, you can often block callers with your router or handset. You may contact your provider or phone company to ask for more details about this option.

- Register yourself at the Do Not Call Register – telemarketers are not allowed to call you if you are registered there.

- Check for fraud text messages! Look for suspicious links, spelling mistakes or a strange sender number.

- Carefully choose who you share personal details with online and update privacy settings on social media.

Report Each Scam Call

You should report each spam or scam call on tellows-au.com to warn other users about the number.

The Australian government ACMA published on their website useful information about how to spot scams and how to protect yourself. You can report scams on the Scamwatch website from the Australian Competition and Consumer Commission.

Have you been victim of a scam call or did you successfully evade a scam caller? Leave your story in the comments!