Dear tellows fellows,

Dear tellows fellows,

This week we celebrate the release of our latest annual report!

Your tellows team would like to wish you a happy new year! The new decade officially started more than one week ago and we want to take the chance to thank you all for the support you showed to our website in the past year. So, how has 2019 been as far as phone calls are concerned? Find out in our new annual report!

The annual report contains information about spam trends during 2019, including information about caller type, user and usage stats. This is in addition to general information about the growth of tellows throughout the year, most notably on its social media platforms. Check out our blog article from December 2019 which contains all the useful stats about user activity on tellows.

Download the tellows Annual Report 2019

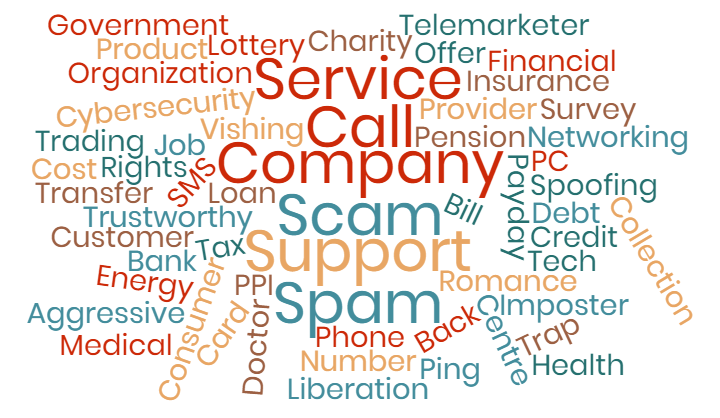

As compared to 2018, in 2019 harassment calls significantly decreased in terms of percentage (from 29% to 19%), but the proportion of calls coming from telemarketers and aggressive advertising has increased. However, more trustworthy numbers have also been reported on tellows, making them the most popular caller type recorded in the UK. Among the most searched numbers from last year are:

- +441709357345 (search requests 113838, ratings 91), which is supposedly a number used by the telecommunication company Vodafone

- +442078553116 (search requests 97080, ratings 98), supposedly identifiable with Amazon Delivery service

- +441844398909 (search request 238744, ratings 85), supposedly EE.

All in all, in terms of caller types, UK users have been reporting more useful calls, even if almost 75% of all calls can be considered as “unwanted”.

In order to make the tellows experience better, last year our team tried to create more engagement with the users by publishing a second version of the tellows magazine in January and was more active on social media platforms.

What is tellows magazine? Briefly put, it is our own magazine available in e-book format which contains all the important information you need to protect yourself against unwanted calls and alleged fraud. The content ranges from general facts about spam calls to ways for reporting them. Download the magazine for free!

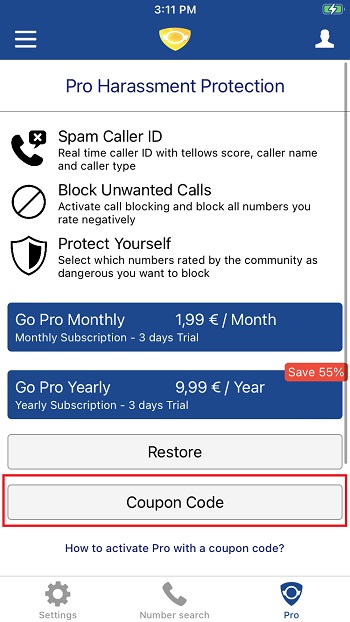

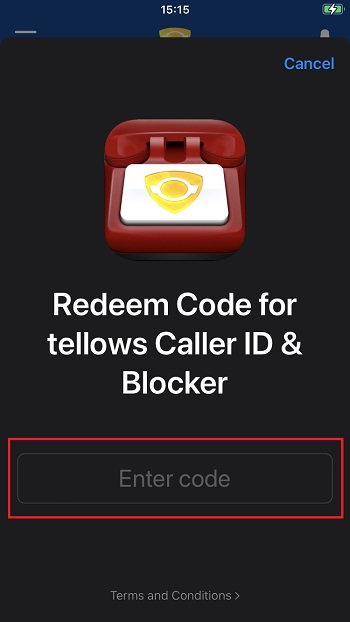

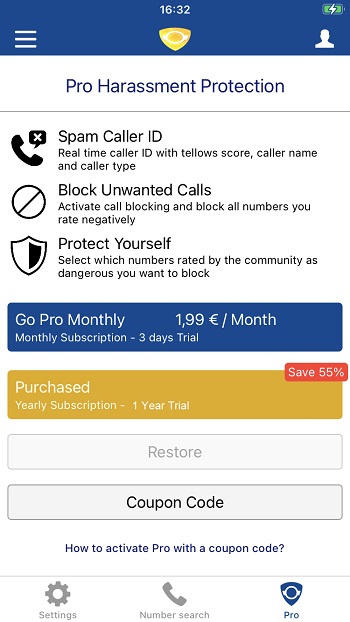

In August 2019 we also achieved an important goal: our downloads on Google Play Store reached 500K! In the last few months tellows has been busy updating the app for Android and was finally able to launch the new version in November with some major changes. How is it better? First of all, we made some new usability updates which make the app generally easier to use, thus ensuring our users have a better experience. More specifically, the app menu has been drastically changed and the settings menu has also been re-structured. Secondly, we have made it possible to view manually blocked numbers by adding the new entry “local scorelist”. Moreover, we introduced a new spam category, which is SMS spam, and now phone numbers can also be assigned to this new caller type. Finally, the app language could be manually changed directly in the app. As for aesthetics, we introduced the tellows man, who is there to introduce new users to the app when it is first downloaded on the mobile device.

At least twice a week we create a new post on Instagram about new spam trends, advices for protection from spam calls and also small curiosities about cultures all over Europe. Of course, the Facebook page remains really active by publishing articles and being ready to answer inquiries from customers.

The annual report 2019 gives you insights into the worldwide scam and spam reports and the top trends of 2019.

Download the tellows Annual Report 2019

With this annual report tellows is officially putting an end to 2019, nevertheless the achievements made during the last year are just going to keep us motivated for improving our service and guarantee all our users major protection against unwanted calls. Thanks for the support!

The tellows team